How to Refinance A Student Loan Online from College Ave

School Ave Student Loans is streamlining the understudy advance understanding so understudies can continue ahead with what is important most: getting ready for a splendid future. As an online commercial center moneylender with a sole spotlight on private understudy advances, they’re utilizing innovation and their profound industry mastery to interface families who need to take care of training costs with banks who can give that subsidizing.

Why choose College Ave

-

Straightforward

Truly. Smooth and direct is what they’re about, so apply from any gadget in only three minutes; and discover in a flash if your credit’s affirmed.

-

Clear

They need you to recognize what you’re getting, how it works, and how to spare however much as could reasonably be expected, so their instruments are straightforward, to-the-point, and peaceful.

-

Individual

They give unique help that is definitely not one-size-fits-all. They’re here for you consistently you the most ideal credit.

The services of college Ave

-

Undergrad Student Loans

Overpowered by school costs? How about they check whether they can help. Their understudy advances can conceal to 100% of your expense of attendance1, including educational cost, charges, books, lodging, and other school costs. They’ll coordinate you with a credit you can live with from reimbursement choices that fit your month to month spending plan to serious loan fees. All that’s needed is three minutes to apply and get a moment credit choice.

-

Graduate Student Loans

You’re sure about seeking after your propelled degree, presently figure out how to pay that you can be positive about as well. Without a doubt, a College Ave advance can assist you with taking care of the expenses of a postgraduate, aces, doctoral, or proficient degree. However, more than that, we give adaptable reimbursement alternatives and never charge start expenses. This is the reason, their application takes only three minutes, and you’ll get a credit choice right away.

-

Parent Loan Possibilities

You raised the understudy, they increased present expectations on advances to pay for school. With your solid credit, you can help pay for your youngster’s training with a modified parent advance. Like our different credits, we never charge beginning expenses and give reimbursement adaptability. Far better, we give you the alternative to get up to $2,500 of the loan1 conveyed directly to you so you control the spending on additional training costs like books, hardware, or quarters supplies. Prepared to begin? Their application takes only three minutes and you’ll get a moment credit choice.

-

Renegotiate Your Student Loans

Renegotiating a current understudy credit with College Ave can genuinely lessen your regularly scheduled installments and even the all-out expense of your loan. With low fixed or variable financing costs, no application or beginning charges, and even lower loan costs when you pursue auto-pay, they have loads of approaches to bring down your installments and feeling of anxiety.

How to apply for refinancing of Student Loan Online from College Ave

To apply go to, www.collegeaverefi.com

Here, at the top right part tap on, ‘Apply’.

Here you will get options, here tap on, ‘Refinancing’.

Here you have to choose between

-

Borrower

-

Cosigner

For the Borrower, you can check your rate in one minute. Here tap on, ‘Get started’. Here enter,

-

First Name

-

Middle Initial (optional)

-

Last Name

-

Suffix (optional)

-

Email

-

Phone

-

Permanent Address

-

Address 2

-

City

-

State

-

Zip Code

-

Date of Birth

-

Citizenship

-

Social Security Number

-

Confirm Social Security Number

-

Your Total Annual Income

-

Estimated Amount to Refinance

-

Highest Degree Obtained

-

State of the Last School You Attended

-

Name of the Last School You Attended

-

Agree to the terms

-

Then, tap on, ‘Check my rate’.

If you want to return to an existing application, tap on, ‘Return to an existing application’. Here enter,

-

The 14-Digit Reference Number you have with you

-

Last 4 digits of Borrower’s Social Security that you have with you

-

Here, tap on the button, ‘Find’.

For the Cosigner application enter,

-

The 14-Digit Reference Number you have with you

-

Last 4 digits of Borrower’s Social Security that you have with you

-

Here, tap on the button, ‘Find’.

For Undergraduate student loan, you will get two options,

-

Student borrower

-

Cosigner

With the Student borrower, tap on, ‘Start a new application’. Here tap on, ‘Get started’, then, enter,

-

First name

-

Middle Initial (optional)

-

Last Name

-

Suffix (optional)

-

Email

-

Phone

-

Permanent Address

-

Address 2

-

City

-

State

-

Zip Code

-

Date of Birth

-

Citizenship

-

Social Security Number

-

Confirm Social Security Number

-

Your Total Annual Income

-

Year in School Loan Will Help Cover

-

School State

Search by school name or 8 digits of the department

-

Enrollment Status

-

Estimated Graduation Date

-

Loan Period

-

Estimated Cost of Attendance

-

Estimated Financial Assistance

-

Requested Loan Amount

-

Give consent to the terms

-

Then, tap on, ‘Review terms’.

For the existing application enter,

-

The 14-Digit Reference Number you have with you

-

Last 4 digits of Borrower’s Social Security that you have with you

-

Here, tap on the button, ‘Find’.

For the cosigner, you must follow the same steps.

For the other applications you have to follow similar skills.

Also Read : Access To Amtrak Guest Rewards Account

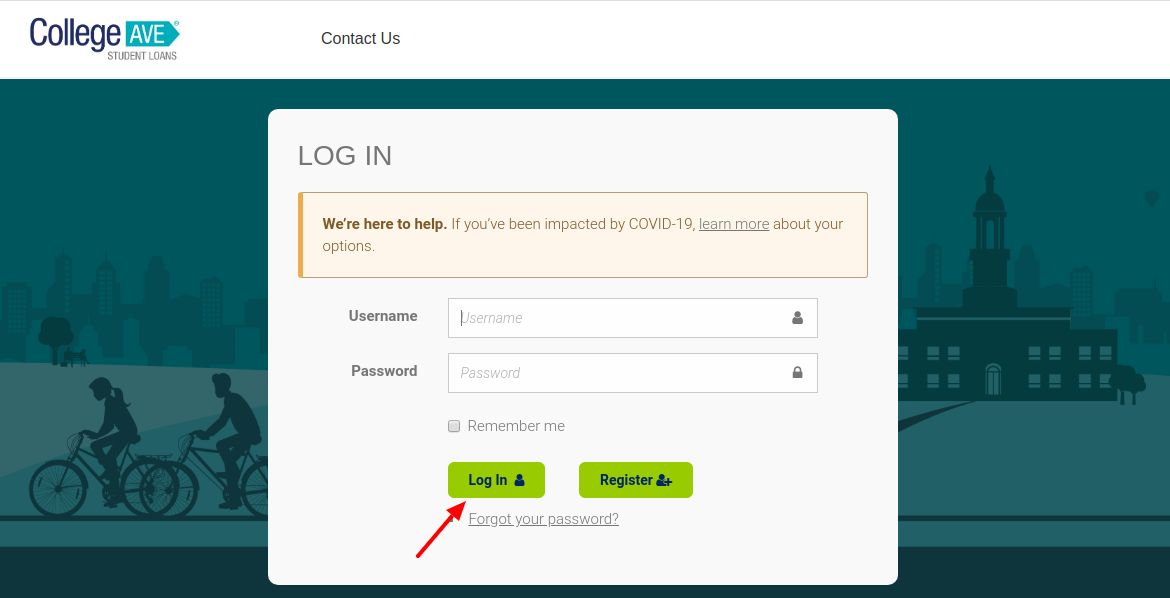

How to register with College Ave

To register go to, www.collegeaverefi.com

Here, at the top right part tap on, ‘Pay my loan’. Here in the block, you will see the login blanks, and under that tap on, ‘Register’. Here input,

-

Username *

-

Password *

-

Confirm Password *

-

Email Address *

-

Phone Number *

-

Date of Birth *

-

Zip or Postal Code *

-

SSN *

-

Then, tap on, ‘Sign up’.

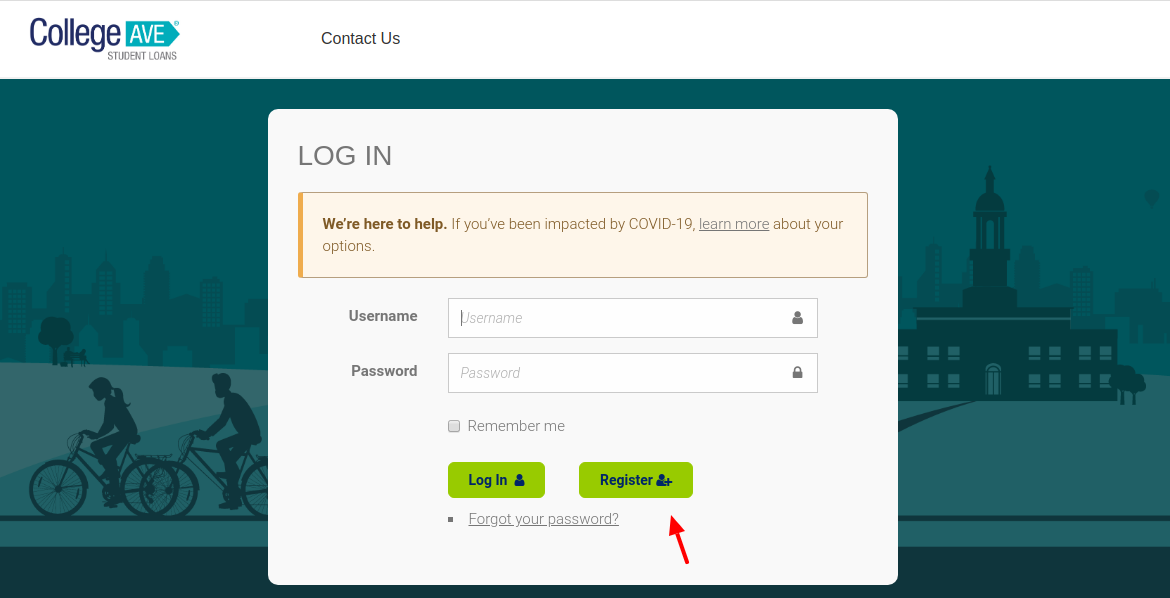

How to log in with College Ave

To log in go to, www.collegeaverefi.com

Here, at the top right part tap on, ‘Pay my loan’. Here in the block, you will see the login blanks, here input,

-

Username

-

Password

-

Then, tap on, ‘Log in’.

To pay for the loan you need to login.

Password help

To get password help go to, www.collegeaverefi.com

Here, tap on, ‘Forgot your password?’. Then, enter,

-

Username: *

-

Email Address: *

-

Phone Number

-

Then tap on the button, ‘Send password reset link’.

How to pre-qualify with College Ave loans

To pre-qualify go to, www.collegeaverefi.com

Here scroll down towards the bottom tap on, ‘Prequalify’.

Here for refinance enter,

-

First Name

-

Middle Initial (optional)

-

Last Name

-

Suffix (optional)

-

Email

-

Contact Information

-

Phone

-

Permanent Address

-

Address 2

-

City

-

State

-

Zip Code

-

Date of Birth

-

Citizenship

-

Social Security Number

-

Confirm Social Security Number

-

Your Total Annual Income

-

Estimated Amount to Refinance

-

Highest Degree Obtained

-

State of the Last School You Attended

-

Name of the Last School You Attended

-

Give consent to the terms

-

Then, tap on, ‘Check my rate’.

For undergraduate student loan enter,

-

First Name

-

Last Name

-

Middle name

-

Date of birth

-

Street Address

-

Zip Code

-

Email Address

-

Give consent to the terms

-

Then, tap om, ‘Prequalify’.

For career, graduate and parent loan type the same.

Contact details

To get more contact help call on, 888-567-8688. Also, write to, 233 N. King Street, Suite 400. Wilmington, DE 19801. Also, check the social media links,

Reference :

www.facebook.com/collegeaveloans