There are many contributing styles, yet toward the day’s end what is important most is the opportunity to contribute your direction. That is the reason Bank of the West Investment Services, Bank of the West’s subsidiary representative/seller, offers a scope of contributing methodologies that can remain solitary or be mixed contingent upon the degree of direction and inclusion you want.

Why Choose Bank of the West

- In case you’re sure about your contributing information and incline toward an involved methodology, Online Investing through Bank of the West Investment Services permits you to deal with a bit or the entirety of your portfolio yourself.

- On the off chance that you like to contribute with more direction, the learned counselors at Bank of the West Investment Services can help you in distinguishing arrangements that line up with your generally monetary arrangement.

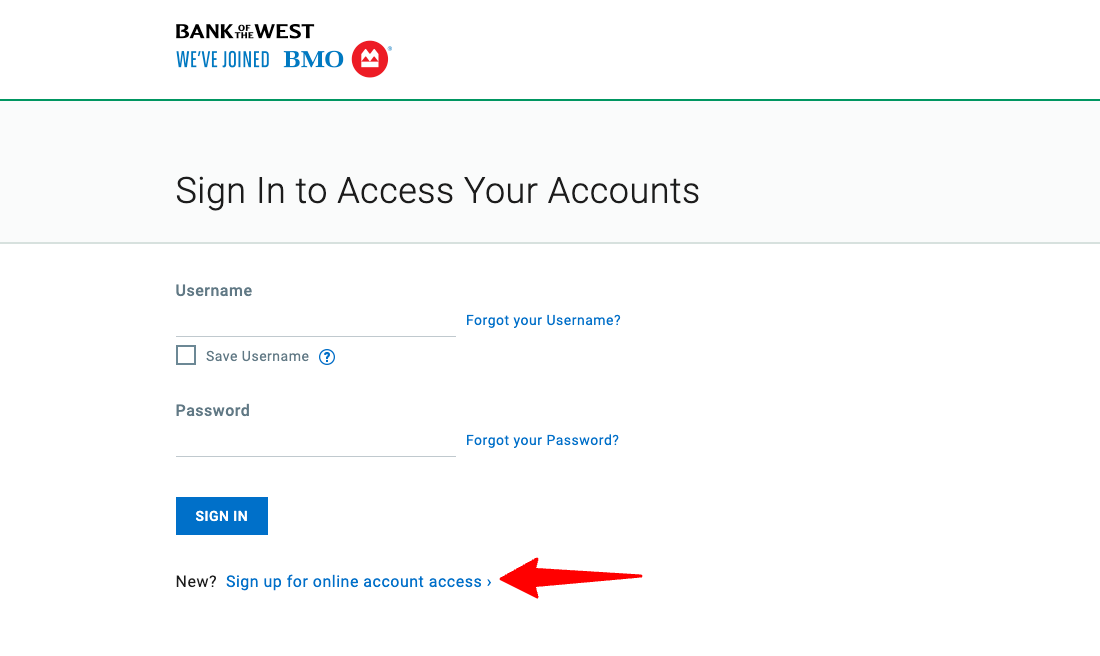

How to Sign Up for Bank of the West Account

- To sign up for the account, open the page, www.bankofthewest.com

- Once the page appears on the login homepage click on the ‘Sign up for online account access’ button.

- In the next screen choose your account and proceed with the signup prompts.

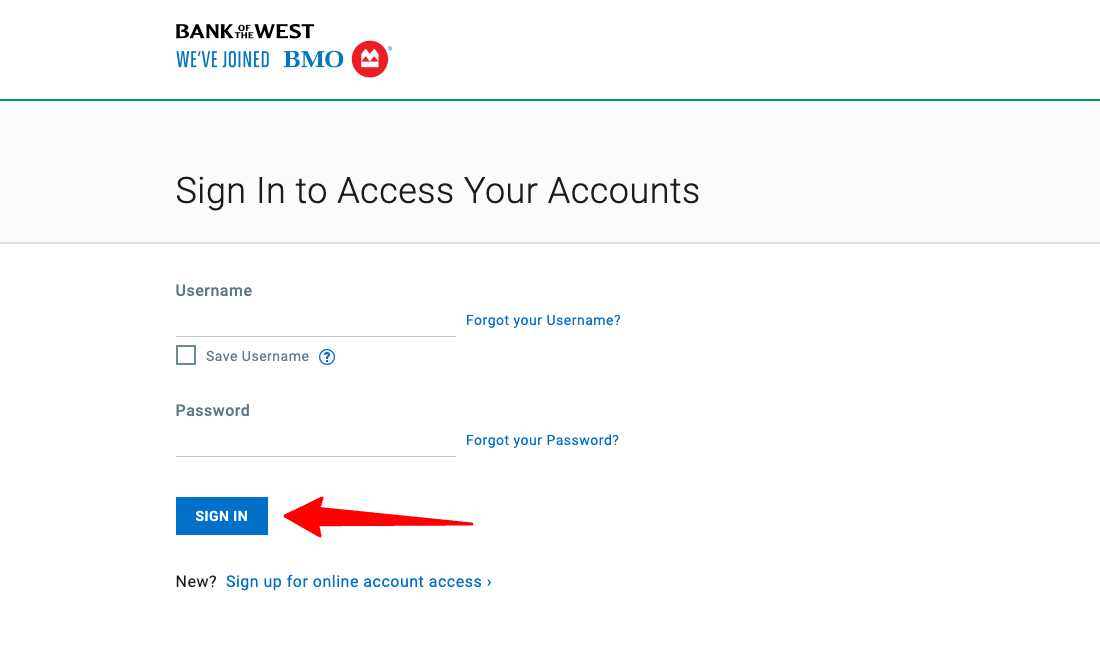

Bank of the West Online Bill Pay

- For online bill pay open the page www.bankofthewest.com

- After the page appears, at the top right click on, the ‘Sign in’ button.

- On the next screen, provide a username, and password, and click on the ‘Sign in’ button.

How to Retrieve Bank of the West Login Credentials

- To retrieve the details, open the page, www.bankofthewest.com

- As the page appears on the login homepage, tap on the ‘Forgot your username?’ button.

- In the next screen choose your account and proceed with the prompts.

Bank of the West Bill Pay by Mail

- You can also pay the bill through the mail. You have to send the bill to the particular address.

- Send it to the address from your invoice: 180 Montgomery Street San Francisco, CA 94104.

Bank of the West Bill Pay by Phone

- You will get an option for phone payment

- You have to call on 800-488-2265.

Also Read

Bank of the West Account Features

- Bank of the West offers its clients the simplicity of on the web and versatile banking. At the point when you access your record on the web, you can follow your spending and financial plans, take care of tabs, move cash, set up email and text-based notifications, and then some. A large part of the equivalent is additionally obvious when you bank on the versatile application.

- The majority of the accompanying financial balances have the least store necessities and charge month-to-month expenses. It’s essential to look at those so you don’t get walloped when you open a record. This investment account from the Bank of the West surely satisfies its name, offering a work of art and basic interpretation of reserve funds.

- While the record procures at the most reduced financing cost in the business, you won’t confront charges for stores and withdrawals when you make them at a branch or ATM. As an investment account, you’re restricted to six active exchanges for every assertion cycle. Every exchange over that cutoff will cause a $15 charge.

- This endorsement of store alternative from Bank of the West permits you to browse various term lengths. You can open anything from a 32-day CD for momentary investment funds objectives to a 60-month CD for a more drawn-out term reserve funds project. To exploit the term assortment, you may even need to stepping stool your CDs for the most extreme investment funds since the rates aren’t the most noteworthy.

- Interest in this CD is determined every day and accumulated month to month. Similarly, as with most CDs, you can’t get to your assets until it arrives at the finish of its term, known as its development date. You’ll have a 10-day elegance period after the development date to put aside installments, withdrawals, or moves. Something else, the record will just reestablish naturally at a similar term length.

Bank of the West Customer Information:

To get more details to call on 800-488-2265.