Consumer Reports Login Guide :

Customer Reports is a free, charitable part association that works next to each other with shoppers for truth, straightforwardness, and reasonableness in the commercial center. Customer Reports attempts to make a reasonable and only commercial center for all.

As a mission-driven, free, charitable part association, CR enables and illuminate’s purchasers, boost organizations to act capably, and assists policymakers with focusing on the rights

Why Choose Consumer Reports:

- Interests of customers to shape a genuine shopper-driven commercial center.

- CR is as yet an autonomous not-for-profit with in excess of 6 million individuals who battle with their voices decisions for a reasonable and just commercial center one that is responsive and versatile enough to convey trust to purchasers regardless of what changes come their direction.

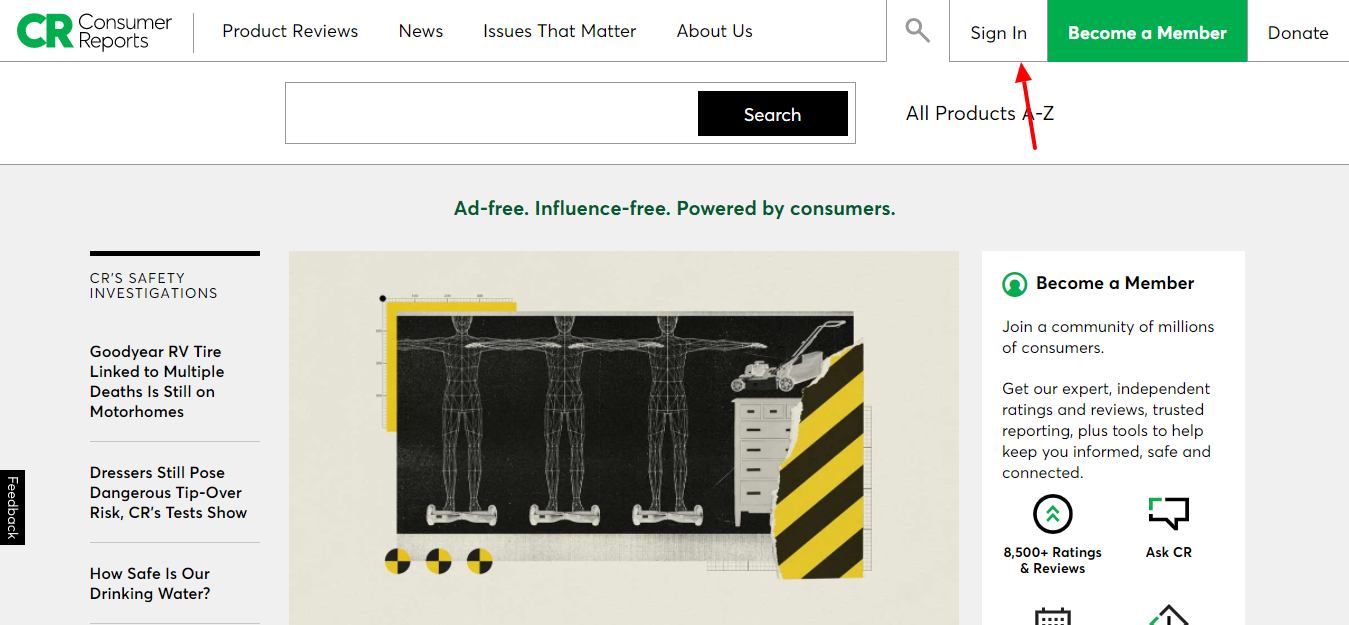

Consumer Reports Login:

- For the login open the website www.consumerreports.org

- As the page opens at the top right click on ‘Sign in’ button.

- In the login homepage provide email or username, password. You have to click on ‘Sign in’ button.

Retrieve Consumer Reports Login Details:

- To retrieve the login initials open the page www.consumerreports.org

- After the page opens in the login homepage hit on the ‘Forgot username’ button.

- In the next provide account email click on the ‘Submit’ button.

- For password reset provide the account email hit on the ‘Submit’ button.

Enroll in Consumer Reports Account:

- To enroll in the account open the page www.consumerreports.org

- Once the page appears on the login homepage click on the ‘Join today’ button.

- In the next screen choose the plans you want and proceed with the prompts.

Also Read : Access to Alpine Communications Account

Retirement Benefits without 401(k):

- Singular Retirement Accounts: An individual retirement account is an expense-advantaged account that holds speculations that you pick. There are two fundamental sorts of IRAs conventional and Roth and the greatest contrast between the two is the point at which you make good on your expenses.

- Customary IRAs: With conventional IRAs, you get a forthright tax cut. You can deduct your commitments when you record your yearly assessment form. The cash in the record develops tax-exempt. Be that as it may, when you take cash out during retirement, it’s burdened as standard pay.

- Roth IRAs: A Roth IRA doesn’t give a forthright tax reduction. Yet, qualified withdrawals—those made after age 59 1/2 and when it’s been at any rate a long time since you previously added to a Roth—are tax-exempt. This can be a gigantic benefit, particularly on the off chance that you hope to be in a higher duty section during retirement.

- IRA Contribution Limits: Whether you have a customary or Roth IRA, the yearly commitment limits are something similar. For the assessment years 2021, you can contribute up to $6,000, or $7,000 in case your age 50 or more seasoned a get up to speed commitment for workers moving toward retirement age.

- Wellbeing Savings Accounts: If you don’t know you can save $1 million out of an IRA alone, a Health Savings Account can be a covert method to support your retirement reserve funds. While HSAs are proposed to pay for medical care costs, they can be an important kind of revenue once you resign.

- HSA Withdrawals in Retirement: You can generally pull out cash from your HSA tax-exempt and punishment free for qualified clinical expenses. In retirement, you can pull out HSA cash for things other than medical services without bringing about an assessment punishment. When you turn age 65, you can utilize HSA assets under any condition.

- Available Investment Accounts: If you maximize an IRA and a HSA, an available venture account is another choice to consider. These accounts don’t offer any assessment benefits like deductible commitments or tax-exempt development. Be that as it may, you have a shot at acquiring preferred returns over you would by stopping your additional money in an ordinary bank account.

Consumer Reports Customer Support:

If you want to get in touch with the company call on the toll-free number 1-800-333-0663.

Reference Link: